Taking tech solutions to the next level

Harness the power of modern technology with an experienced team trusted by top global companies to bring your business idea to life.

Services

From end-to-end scalable software development to flexible support and maintenance, we deliver a wide range of services that are easily tailored to your project requirements and business needs.

Rely on our professional web development services to create high-performance, user-centric, and secure web products tailored to your specific requirements and driven by results.

With our qualified professionals, we provide businesses with comprehensive IT Outstaffing services to help them find the right talent for their projects with customized staffing solutions.

Use our one-of-a-kind recruitment approach to grow your team rapidly. We provide a range of recruitment methods to provide the most effective and personalized search for the candidates you want.

Turn your ideas into reality with our tech experts. Our experience across a variety of business domains offers you the tools you need to succeed.

We build and customize software solutions, overcome specific business challenges, or upgrade your system with an experienced and reliable partner by your side.

We go the extra mile to help you build strong emotional bonds with users through human-centered visuals and a flawless UX that attracts, engages, and delights.

Benefit from our skills and deep tech expertise to validate your ideas and develop a comprehensive IT strategy for your company’s digital and technical transformation.

Reduce risk with our robust testing mechanisms to detect potential issues and defects early and ensure your product’s impeccable quality for smooth and efficient interaction.

We modernize and enhance your software product to ensure its high availability, reliability, functionality, and relevance to the current needs of your business.

testimonials

Find out more about our client’s experience working with Ficus Technologies and its results for their business.

Business clients

We are trusted by both emerging businesses and top global companies who appreciate our dedication to achieving their business goals.

Thinking about

outsourcing?

Innovate, market faster, and gain a competitive edge with our services.

Case studies

Dive into our recent case studies and find out what value we have been able to bring to our clients.

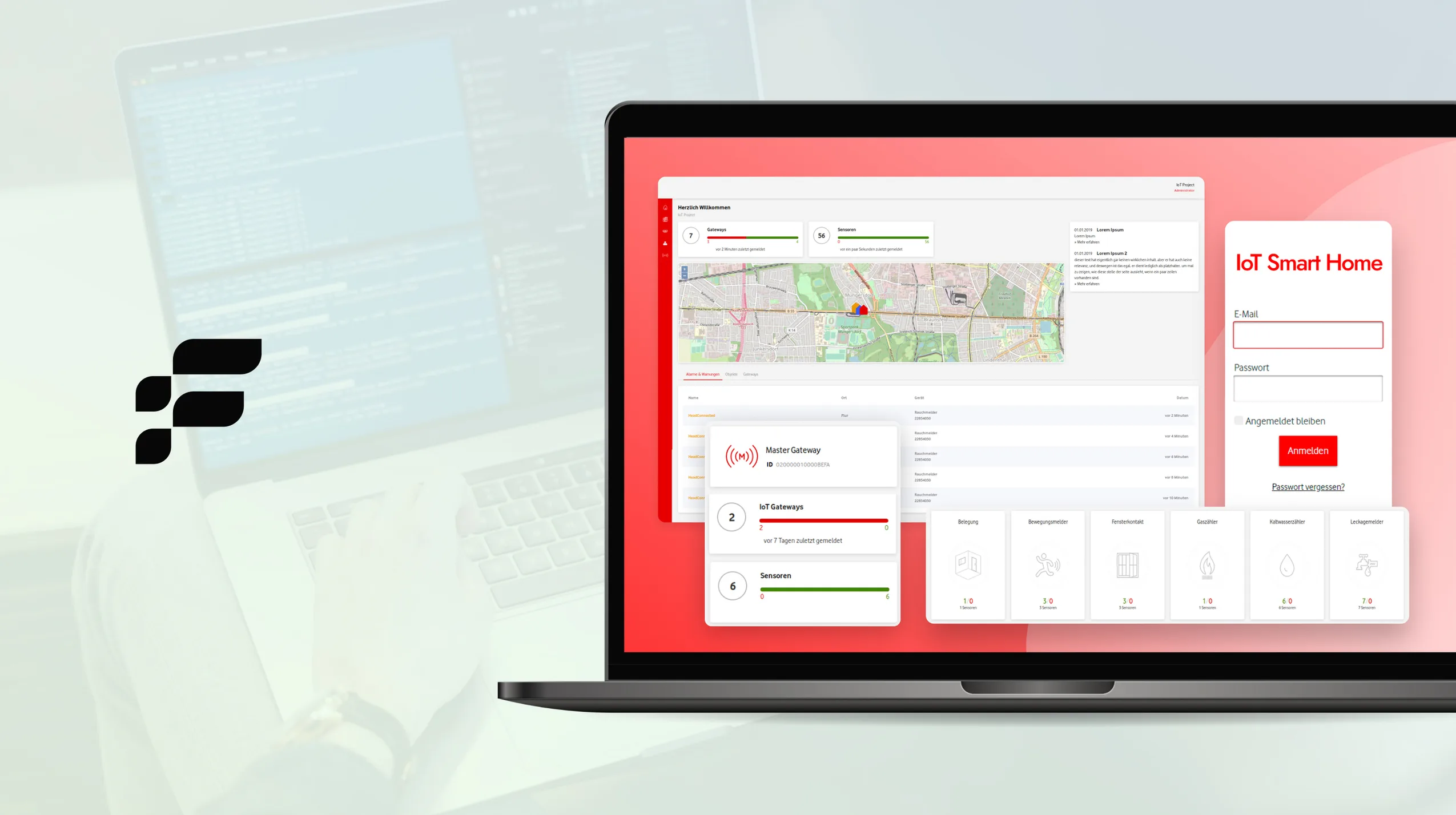

The product makes it simple to securely enroll, organize, monitor, and remotely manage IoT devices at home, over an entire floor, or across a whole building.

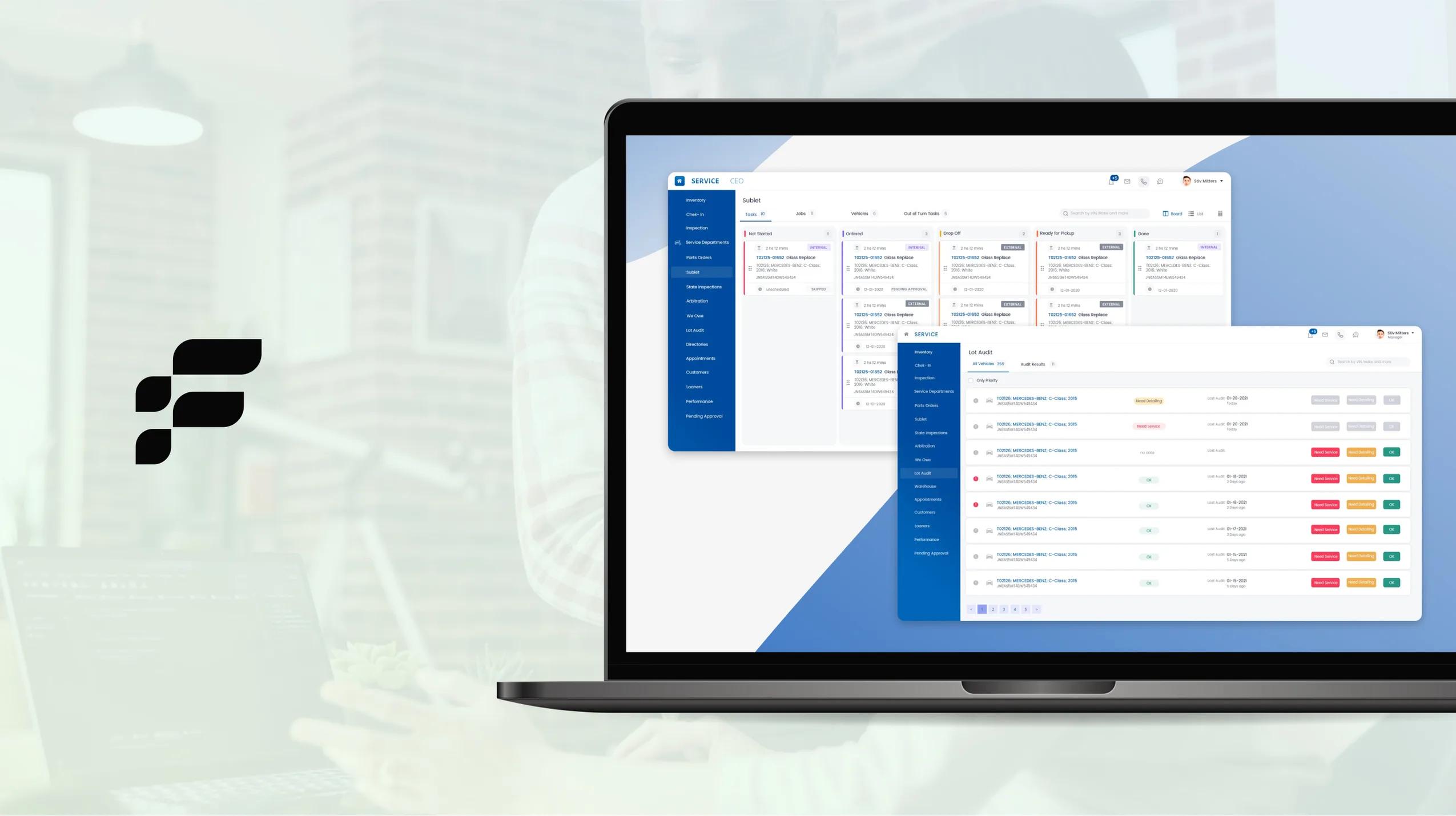

Puzzle-DMS is an auto-boutique CRM system that manages the entire buy-sell lifecycle. The software enables our customers to automate activities and assists in planning, budgeting, forecasting, and accurately reporting an organization’s financial health.

Frequently asked questionS

Find out everything you need to know about the terms of cooperation with us, our technological expertise, and other details that may interest you.

There are many reasons outsourcing product development can be beneficial to companies:

– You don’t need to create your team.

– You reduce the costs.

– You can choose a qualified partner with expertise in a particular domain.

– You need skills for a short time.

– You get a fresh perspective and innovative ideas.

– You can expand your business network.

It depends on the number of candidates, their experience, etc. Usually, it takes 2-3 weeks. Our IT Staffing and recruitment services allow you to access our vast database and deep network of existing contacts in various industries and take advantage of our latest recruitment technologies.

The source data and project progress are only accessible to you and your development team. We keep the code on a private, secure server only you and the dedicated developers can access. We do not use or disclose your sensitive data in any form.

The discovery phase is a business analysis stage, aiming to determine the business need, optimal architecture, and functionality of the future project, defining what is essential or redundant to the project in a way that will satisfy the owner’s vision and suit the market demands.

The Discovery Phase helps to refine the concept of a project, making the project more competitive and profitable. The phase helps to decrease project costs by omitting redundant and irrelevant functionalities, which may harm the overall performance of a project. Moreover, the Discovery Phase guarantees more accurate estimates.

Yuliia Borodavko

Client Engagement Director